19 December, 2022

RECOMMENDATIONS FOR BUDGET : 2023-2024

Introduction

1. Budget 2023-24 has fine-tuned equitable and sustainable growth, job creation, fiscal consolidation and inflation management. Domestic economy will be the key growth driver in the year 2023-24 as Global demand could shrink due to headwinds such as high inflation in major economies and supply chain disruptions due to the ongoing Russia Ukraine conflict.

2. This year's budget is themed around The Seven Pillars (Saptarishi) which complement each other and act as the guiding principles to take us through Amrit Kaal (Golden Age).

RECOMMENDATIONS

Fiscal Responsibility and Budget Management (FRBM) ACT

3. Fiscal Deficit proposal of 5.9% of GDP for 2023-24 is lower than this year's 6.4% of GDP which is laudable taking into consideration the Global situation. The government will have to support domestic demand and crowd in private investment. In view of this, there is a need to have comprehensive review of Fiscal Responsibility and Budget Management (FRBM) Act. Instead of having a fixed limit it should give tolerance band to bring in flexibility in the system. If the economy growth demands, the Act must let the fiscal expand to impart a boost to the growth.

Public Debt to GDP

4. The growing government debt which has gone up to Rs 155 lakh crore is a real concern for the economy. At present the Per Capita Debt in the country is Rs 1,09,000. Road map needs to be announced to contain it as a part of Fiscal Consolidation to bring it down to acceptable limits.

5. Tax to GDP Ratio is estimated at 11.1%. This needs to be increased by widening the Direct Tax base.

Current Account Deficit/ Exports

6. Current Account Deficit may decline further owing to falling Exports and rising Import bills. India merchandise exports fell 6.58% year on year in January 2023. Trade deficit touched a 12 month’s low in January 2023. The govt must come out with a plan to achieve exports in global trade to 3% by 2027 and 10% by 2047 from the current 2.1%. Promote Export based imports at a lower rate of Customs Duty. Have an aggressive strategy to promote Services Exports as it is easier to increase Services exports in a short time and will also help in creating Jobs. Concept of branding of Services Exports could be considered by involving Embassies abroad and NITI Aayog.

7. Govt also needs to promote Exports through Free Trade Agreements and Early Harvest Agreements giving due protection to domestic industry. Set up a trade body as an autonomous organisation under Commerce Ministry on the lines of investment India. Foreign Trade Policy to be announced in April 2023 and development of Enterprises and Services Hub bill should be futuristic and Export friendly to integrate Indian economy with the global economy. Industry and the Government must work in tandem to tap shrinking opportunities and the relevant strategy.

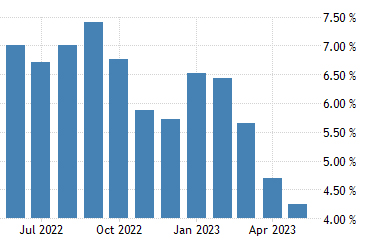

Inflation

8. Retail and wholesale inflation stood at 6.5% and 4.7% respectively in January 23. It is the key risk to the growth outlook. RBI has projected 5.3% inflation in 2023-24. To contain inflation, measures required are:

8. Retail and wholesale inflation stood at 6.5% and 4.7% respectively in January 23. It is the key risk to the growth outlook. RBI has projected 5.3% inflation in 2023-24. To contain inflation, measures required are:

(a) Harmonisation of Monetary, Fiscal & EXIM policies;

(b) Incentivise the private sector for crowding in investment;

(c) Import Duty reduction to control prices to enhance supply;

(d) Ban on Exports of items having demand push inflation;

(e) RBI to monitor it closely for management of key rates and to avoid overtightening of Monetary Policy;

Rupee Depreciation

9. Global uncertainties may result in dollar appreciation. Rupee averaged at 79.7 in April-December 2022 against 74.2 in April-December 2021, a depreciation of more than 7%. However, it needs to be ensured that Rupee's Real Effective Exchange Rate (REER) does not appreciate, since it will have a negative impact on domestic value addition and job creation.

9. Global uncertainties may result in dollar appreciation. Rupee averaged at 79.7 in April-December 2022 against 74.2 in April-December 2021, a depreciation of more than 7%. However, it needs to be ensured that Rupee's Real Effective Exchange Rate (REER) does not appreciate, since it will have a negative impact on domestic value addition and job creation.

Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS)

10. The allocation of Rs 60,000 crores to this 17 year old demand based Flagship Rural Jobs scheme is 18% lower than the Rs 73,000 crore for the current year. MGNREGS should not be treated as a regular employment scheme. Following needs to be considered to make it effective & stop leakages:

10. The allocation of Rs 60,000 crores to this 17 year old demand based Flagship Rural Jobs scheme is 18% lower than the Rs 73,000 crore for the current year. MGNREGS should not be treated as a regular employment scheme. Following needs to be considered to make it effective & stop leakages:

(a) There should be greater diversification of permissible works;

(b) Involve Gram Sabha’s in fund management (payments);

(c) Wages should be at par with market rate;

(d) Capture the attendance through Mobile phone-based app;

(e) Make mandatory Aadhaar based payment of wages;

(f) Change the contribution (pattern) of wage bill to a 60-40 ratio between the Centre and the States, instead of the Centre bearing 100% of the wage bill.

(g) Ensure that the scheme is more inclusive for the women workforce

Disinvestment/ Monetisation of Land

11. To put Disinvestment and Monetisation of land and building assets of Central Public Sector enterprises namely IDBI bank, Container Corporation of India Limited (CONCOR), Shipping Corporation of India, Bharat Earth Movers Limited (BEML) and others on fast track, appoint international consultants and pricing should be realistic. Further, to enhance confidence of retail investors in CPSUs shares, Govt can provide safety net mechanism through buy back of shares.

Education/ Health/ Rural Sector

12. At present our investment on Education and Health sector is around 3% and 2.1% respectively of GDP. Target should be to enhance it to 6% and 2.5% in short term. Focus needs to be continue on rural development to generate rural demand.

12. At present our investment on Education and Health sector is around 3% and 2.1% respectively of GDP. Target should be to enhance it to 6% and 2.5% in short term. Focus needs to be continue on rural development to generate rural demand.

13. India’s Ranking on UN’s Human Development Index (HDI) has remained the same over the years suggesting that economy is not better off than economies growing slower than India. Economy continues to be ranked in the medium category. Crossing the threshold into high category will take long time. There is an imperative need to take immediate steps on Health, Education, Rural Development, Urbanisation structure and relevant social sectors by involving NITI Aayog.

Railways

14. Failure to generate internal revenue has resulted in high dependence on budgetary support. In this year, it is estimated to be 92% of its capital expenditure. The operating ratio at present is 98.22%. This, needs to be brought down, as 85% of railways network has been electrified. To compare with Income Tax department, Railways spend only 57 paisa for every 100 rupee taxes collected. Except in AC 3 tier, in all other classes Railways is incurring losses. Govt needs to take tough and bold decisions on passenger fares. Govt must encourage Corporates to use Railways instead of road transport. Rail Green points should be encouraged.

Defense

15. Defense has got the highest allocation among all ministries and highest allocation ever at Rs 5,94,000 crore; a 13% increase on YoY basis from last year's budget estimate. Present situation demands an enhanced need of budgetary support taking into consideration our hostile neighbours.

15. Defense has got the highest allocation among all ministries and highest allocation ever at Rs 5,94,000 crore; a 13% increase on YoY basis from last year's budget estimate. Present situation demands an enhanced need of budgetary support taking into consideration our hostile neighbours.

Green Growth Push

16. India has committed to cutting the emission intensity (emissions per unit of GDP) of its growth by 45% (of 2005 levels) by 2030. It has been doing this partly via the Perform, Achieve and Trade (PAT) scheme, where 1000 industries have been involved in procuring and trading energy saving certificates (ESCerts). To give further push to Green growth Govt should expedite setting up of Carbon Trading market in India. This will accelerate shift away from the fossil fuel.

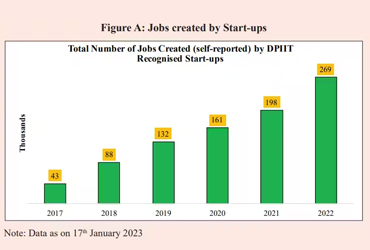

Job Creation

17. Government has to adopt the role of a principal employment generator. Govt may create jobs through MGNREGA in urban areas through a dedicated scheme involving private sector participation.

17. Government has to adopt the role of a principal employment generator. Govt may create jobs through MGNREGA in urban areas through a dedicated scheme involving private sector participation.

18. The Unemployment rate in January 2023 fell to 7.1%. According to a survey out of 43 countries, only 9 had an unemployment rate that was higher than India’s. They are Greece, Italy, Spain, Turkey, Chile, Brazil, Colombia, Egypt and Saudi Arabia.

GST/Carbon Tax

19. Bring petroleum products under the GST system to contain inflation and have “one Nation one Tax”. As it is taxed now, fuel delivers revenue for climate mitigation. Bringing it within GST and imposing a separate Carbon Tax to fund will smoothen the process to energy transition.

Personal Income Tax Regime (New)

20. The phasing out of old Personal Income Tax regime will affect the savings rate and hit investments. Under the new tax regime, conspicuous consumption among the youth will go up as they will have higher take home salaries. In the absence of Social Security and Health benefits the old exemption based regime plays an important role and needs to continue. Household savings is vital in developing economies to spur growth.

Capital Gains Tax

21. Capital Gains Tax regime should have been rationalized by streamlining the Tax Rates, period of holding and classification of assets by offering an alternate regime as has been done under the personal income tax.

CSR Expenditure

22. Disallowance of input tax credit on Corporate Social Responsibility (CSR) expenditure may have a regressive impact. Needs to be restored.

Implementation of Proposals

23. To have full advantage of sharp increase in Capital Expenditure of 33%, monitoring is very vital. Gati Shakti and PRAGATI (Pro Active Governance and Timely Implementation) platforms could be used to track implementation of key projects and take timely remedial steps to address reasons for delay in projects.

Conclusion

24. The sharp increase in Capital Expenditure of 33% for the third year in a row will enhance growth potential and job creation and crowding in private investment.

25. India is well on track to becoming a USD 5 trillion economy by 2025 and remain resilient despite macro headwinds and will become a middle income developed nation by 2047. India continues to remain a relative bright spot in the World Economy and will alone contribute 15% of the Global Growth in 2023.

Send your Suggestions